Banking Profitability - Measured and Improved

How Texas Capital Bank uses CostPerform

to measure and optimize their profitability

Challenge

Gain more insights into the profitability per department and eventually, on a per-customer or per-transaction level.

Solution

Cost modelling and department-level profitability analysis, using the CostPerform Expert subscription.

Benefits

A common understanding how to measure profitability as well as full transparency across the bank on what the profitability levels are.

About Texas Capital Bank

Texas Capital Bank is a leading financial institution headquartered in Dallas, Texas. Established in 1998, the bank has become a trusted name in the industry, offering a diverse range of banking and financial services.

Specializing in commercial banking, wealth management, and treasury services, Texas Capital Bank is known for its commitment to innovation, personalized customer service, and community engagement.

With a focus on building strong, lasting relationships, the bank provides tailored solutions to meet the unique needs of businesses, individuals, and institutions.

Texas Capital Bank’s reputation is built on a foundation of integrity, expertise, and a dedication to supporting the economic well-being of the communities it serves.

Looking for costing transparency

Primary challenge:

Which departments bring TCB the most profitability?

Seeking a standardized method for distributing operational expenses

Distinct divisions held varied perspectives on the nature and categorization of costs (such as direct and indirect expenses), resulting in a disjointed understanding of the cost aspect in determining profitability. The different views on profitability prevented Texas Capital Bank from using detailed profitability information in goal and strategy setting.

Lack of integrated systems

Financial information was collected and maintained across various platforms, leading to extensive manual work prone to mistakes and consuming considerable time. Texas Capital Bank required a central, reliable point for the data they used for profitability calculations.

Balancing automation and flexibility

TCB's cost model demanded both automation and the ability to adapt. In practice, their model had to be specific to them, but it should also be automated so it could be run on a monthly basis.

Profitability Insights per Department in Texas Capital Bank

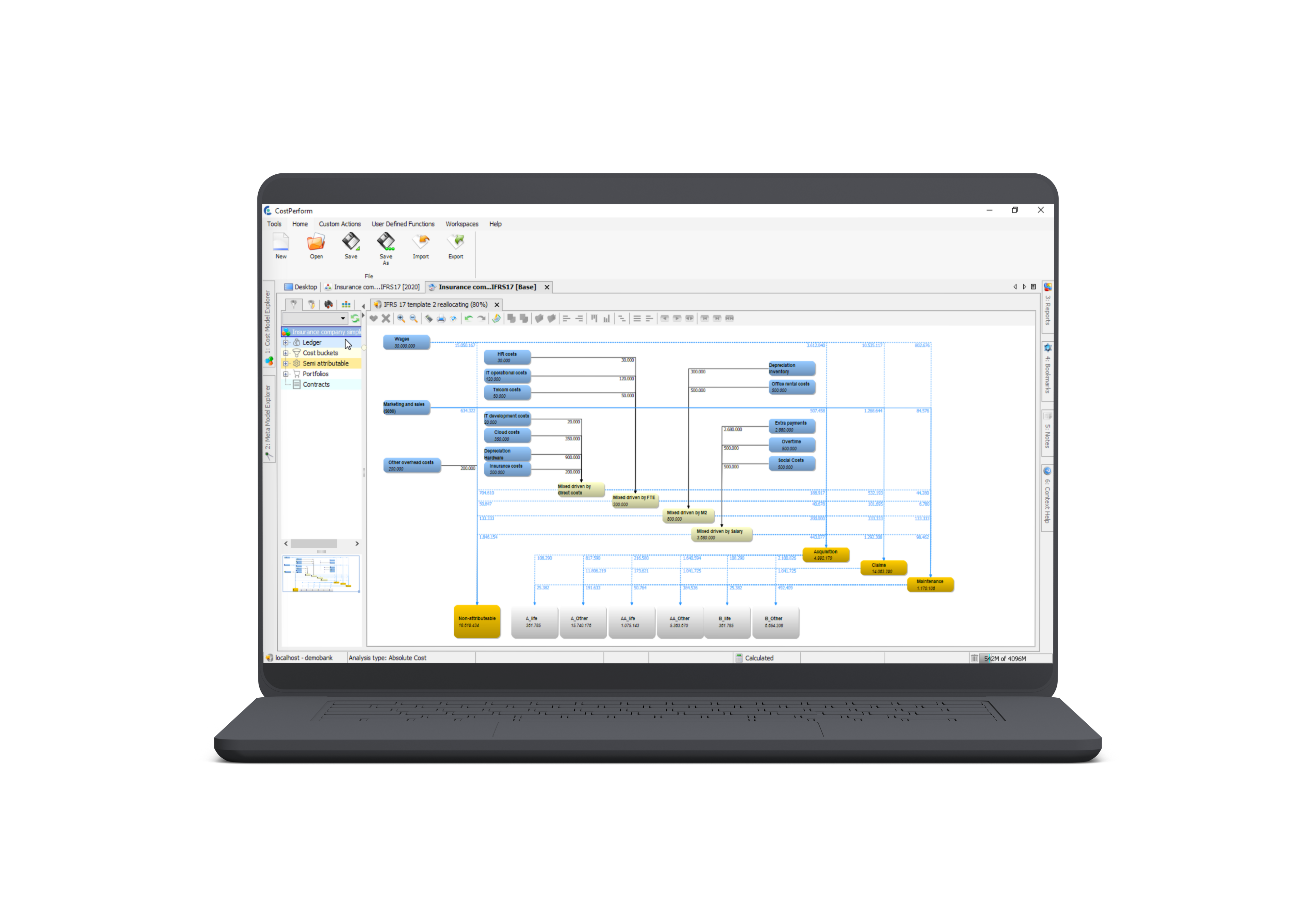

Now, TCB has insights into department-level profitability provided by the CostPerform Expert solution. Furthermore, there is cost transparency across all the model stages. Data input has been automated via an ETL pipeline.

Helping Texas Capital Bank Succeed Towards the Future

Measuring and improving department-level profitability is now possible, but Texas Capital Bank also stands to gain insights into other profitability dimensions, such as product profitability, channel profitability, even down to the level of transaction profitability.

Implementation Together with a Team of Experts

The implementation was done through On-Point Advisory, the preferred partner of CostPerform. Ilias Betkaoui, Costing Manager at On-Point Advisory, adds: "This project was a big challenge with tight deadlines. In the end, we were happy to satisfy TCB. It was one of the most accurate, transparent, and easy to update models we have built. The client can now update the model in a small amount of time. We enjoyed working with the professionals over at TCB."

Texas Capital Bank & CostPerform

True insights into department profitability available in one platform.

This is what the team of Texas Capital Bank and CostPerform delivered together.

Texas Capital Bank can now track all of their cost types (direct and overhead support, direct costs as well as direct reallocation).

Banking Profitability Reimagined and Futureproof

Profitability Analysis Per Department

TCB now knows what their feeders and bleeders are, which departments actually are the most profitable.

Cost-Allocation Transparency

Not just insights into Department Profitability, but the ability to also track down all types of cost, including intercompany charging.

Financial Transparency Going Forward

As TCB develops their cost and profitability modelling, CostPerform is with them every step of the way, helping them to implement Multi-Dimensional Profitability.

About CostPerform

Crafted over 20+ years by econometrists and cost experts, CostPerform is the solution for defining, designing and maintaining your cost and profitability model. Any mathematical approach of cost allocation you can think of, is possible.

From insurance companies and merchant banks to central banks: CostPerform is used by financial institutions to determine profitability, report to regulators and to simulate future business models.

Contact us today to get insights into which products, customers, channels or transactions make you the most money, by allocating the associated costs.