Banks are entering 2026 with a new mix of pressures: tighter margins, stubborn operating costs, and a rising need to prove the value of every dollar spent. The next cycle won’t be won by simply cutting more costs, but by building cost efficiency into the DNA and operations of the organization. Below are four trends that are ongoing, or emerging in 2026. This content is an excerpt from CostPerform’s Banking Playbook for 2026-2028. For more info, you can access that playbook now.

Consolidation returns (an M&A wave)

2025 marked a record year in global dealmaking (mergers and acquisitions/M&A), Deal volume surpassed $4 trillion, a 27% increase over 2024. Fueled by a perfect storm of factors, abundant private capital, and repositioning across industries, what started as a selective consolidation in technology and industrials has broadened into a system upswing.

Charles Rick, global chair of Latham & Watkins sees the trend increasing, “M&A is infectious, the CEO of company A does a big deal and then the CEO of company B starts thinking maybe I need to do something.”

For banks, the surge is not just about consolidation of their own organizations, but advisory and consulting roles on the transactions. Bank of America is set to earn $130M advising Norfolk Southern on a major rail merger.

Prediction #1: M&A activity will continue to surge, and underpin strategic choices for banks in 2026

AI spending accelerates (boom or bubble?)

AI investment has been high for several years across industries. While financial markets grappled with AI bubble fears at the end of 2025, the value proposition underpinning AI investment at major organizations is far from a hype bubble.

AI Spend at US banks is in its early phases. According to BCG, fewer than one in four banks are ready for the AI era.

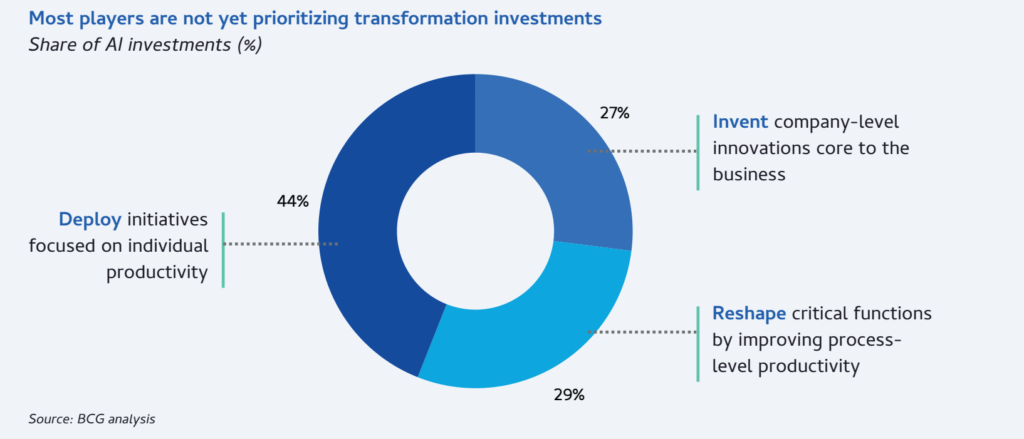

So while spend on AI has risen fast, it is in many cases not aligned to value. Banks will have different approaches to a disruptive technology like AI, so differentiation will emerge. One major Belgian bank, for example, aims to bring AI closer to the company’s core DNA with the Head of AI as a direct report to the CEO.

Shortsighted AI investments may simply be adding an AI layer over technical debt, or investing in medium-term initiatives where savings are hard to realize. The consensus for 2026 is to invest in critical infrastructure and short-term value-proven initiatives. According to the same BCG piece, investment should also shift away from “personal productivity enhancement tools” towards true functional and process reinvention.

Prediction #2: Banks that deploy a successful AI strategy will see significant strategic differentiation emerging in 2026

Inflation eases, but funding and margin pressure linger

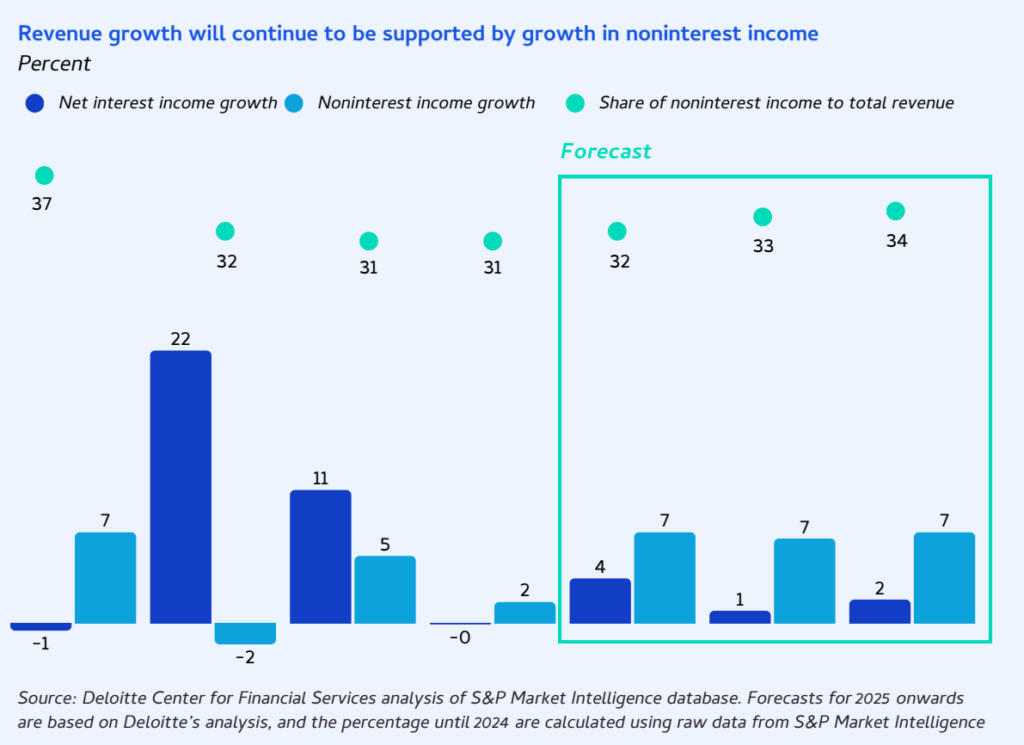

Even as the rate environment normalizes, 2026 is not a “back to easy money” moment. Net interest margin pressure returns in a different form: deposit competition remains intense, funding costs may stay elevated, and revenue growth becomes less dependable. In that environment, expense control stops being a program and becomes a permanent management system.

At the same time, cost inflation doesn’t disappear just because headline inflation has cooled. Wage pressure (especially in highly skilled roles), regulatory change, and the ongoing cost of compliance keep the non-interest expense base sticky. The result is a familiar squeeze where revenue uncertainty and cost rigidity results in a renewed focus on efficiency ratios, operating leverage, and governance that prevents cost creep.

Prediction #3: 2026 brings margin compression dynamics back to the foreground, while operating costs remain structurally sticky.

Sub-$100B banks face increased “scale penalties”

Banks under $100B will feel increased pressure, not because they’re weaker operators, but because the benefits of scale compound

Operating costs such as regulatory compliance, cybersecurity, and core technology upgrades have increasingly become “fixed-cost” investments that do not scale down for a $50B bank versus a $500B bank. This means compliance and IT spending consumes a larger share of smaller banks’ budgets. Many under-$100B institutions also maintain extensive branch networks and legacy systems that larger banks have started to streamline.

There are largely two strategic directions these banks can pursue

- Pursue scale (partnerships, shared utilities, consolidation).

- Push for cost optimization but must run materially leaner operations to compensate for higher structural costs and thinner buffers.

This scale penalties trend may also push some banks toward our first trend, as mergers and acquisitions become increasingly attractive

Prediction #4: The “lack of scale” penalty intensifies in 2026, pushing regional banks toward sharper efficiency, new operating models, and (in some cases) consolidation.

Cost transparency becomes a competitive weapon

These four trends, consolidation pressure, AI investment, margin uncertainty, and scale disadvantages all increase the cost of ambiguity. In 2026, banks thatcan’t explain their cost base will struggle to defend strategy, to boards, regulators, and investors.

But the reverse is also true. Banks that build cost transparency into how they run their organization have major opportunities. Banks must adopt the structured practices aligning closely with best practices for strategic cost optimization (Gartner, 2025)

Want to learn more?

CostPerform’s Banking Playbook outlines what banks can do to succeed in this next cycle. From identifying key trends like the above, to best practices for cost optimization in banking. The playbook was informed by insiders with decades of knowledge in banking in the United States and Europe.