Telecom companies are under more pressure than ever, from skyrocketing data demand and flat-rate pricing to stricter regulatory scrutiny and margin erosion. Yet while services have evolved rapidly, many finance teams still rely on outdated telecom cost models rooted in the voice-era economy.

These traditional models struggle to keep pace with today’s data-driven, bundled, and capital-intensive environment. The result? Inaccurate profitability insights, inefficient pricing decisions, and compliance risk.

This blog post explores the growing chaos in telecom costing, highlighting the structural blind spots that prevent effective financial planning and what CFOs must do to modernize.

Where Traditional Telecom Cost Models Break Down

The telecom sector has undergone a profound transformation over the past decade. Once dominated by voice services and predictable pricing models, telecom now operates in a digital-first ecosystem delivering an increasing mix of bundled services, media, and data-intensive offerings.

This rapid shift has made traditional costing models, designed for static voice services, obsolete. Finance teams across the industry are often left relying on outdated models that fail to account for the complexity of modern telecom operations.

Many finance teams still focus on reporting actuals or budgeting for the next year but lack proactive, forward-looking scenario analysis. Traditional models, based on static assumptions, simplistic averages, or revenue-weighted allocations, do not accurately reflect the true cost structure of modern telecom services.

The result: unclear product profitability, poor ROI visibility on infrastructure investments, and difficulty complying with evolving regulatory frameworks.

“The industry’s legacy business models may not produce sufficient profitability and returns to sustain the required levels of capital investments. Overcoming this may require telcos to embrace new models and extensive, unprecedented collaboration within and beyond the industry.”

— McKinsey & Company

The Shift from Voice to Data and Beyond

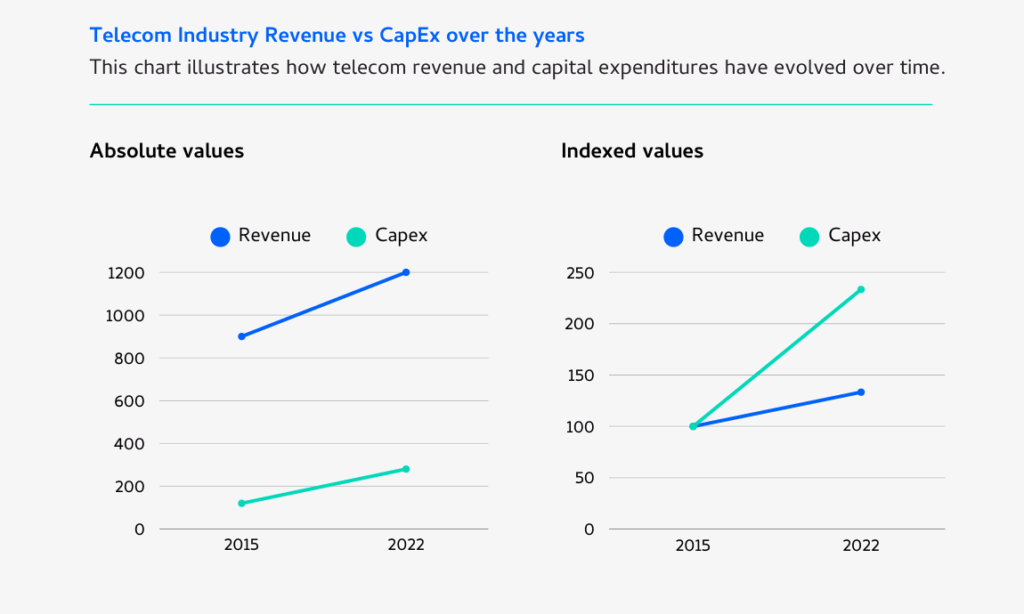

One of the most striking disruptions in telecom is the shift in network demand. Data traffic has exploded, driven by the widespread adoption of 4K video streaming, remote work, connected homes, and AI workloads.

Customers expect unlimited data, flat-rate pricing, and seamless coverage. Meanwhile, the infrastructure costs to deliver these experiences, especially in a 5G and soon 6G environment, are rising sharply.

For CFOs, the question becomes: How do you align cost with services that scale unpredictably?

What Telcos Get Wrong About Costing

Many telecom companies still use average unit cost models to track expenses. While seemingly simple, these models often mask unprofitable segments and create a false sense of financial health.

By averaging costs across bundled or shared services, companies risk misallocating resources and making flawed investment decisions.

“Compliance with pricing regulations adds another layer of complexity. While telecom firms may know the permitted price structure in advance, they often only determine whether they’re within regulatory bounds after actual usage volumes are known.” — Carl Halewood, Telecom Finance Expert

Telcos are also under pressure to cut both Opex and Capex while keeping service levels high. Striking that balance demands smarter cost allocation and cross-departmental collaboration.

“Pricing changes faster than regulation. Consumers want unlimited data, but there are finance teams still modeling by the minute.” — Sander den Hartog, CEO, CostPerform

Hidden Blind Spots in Telecom Costing

Without modern cost models, telcos face numerous blind spots:

Bundled Products Obscure Margins

Mobile + broadband + TV bundles are popular—but they hide the real profitability of each service.

Flat-Rate Pricing Masks Usage Patterns

Charging every customer the same fee ignores cost-to-serve differences and leaves high-usage segments underpriced.

Shared Infrastructure Clouds Wholesale Cost Allocation

As voice networks evolve into data platforms, understanding where wholesale margins originate becomes harder.

Misaligned Allocation Rules Lead to Bad Decisions

Evenly allocating costs across services ignores usage realities and undermines financial accuracy.

These are not just accounting errors – they directly impact product pricing, Capex decisions, and regulatory credibility.

Why Telecom CFOs Must Lead the Shift

Forward-thinking CFOs are now adopting modern telecom cost models that:

- Enable scenario planning and future-state forecasting

- Support compliance with changing price regulations

- Reveal true product and customer profitability

“If you don’t know your real product profitability, you can’t optimize your network or defend your pricing.” — Sander den Hartog, CEO, CostPerform

Advanced tools like activity-based costing and time-driven costing are critical. Equally important is shifting from Excel to enterprise-grade telecom cost allocation software.

A New Era for Telecom Costing

Telecom CFOs can no longer afford to rely on outdated models that don’t reflect the realities of today’s bundled, data-heavy services. With increasing regulatory scrutiny, rising infrastructure costs, and shifting user behavior, now is the time to modernize.

By embracing smarter telecom cost optimization tools and practices, CFOs can uncover hidden inefficiencies, inform strategic decisions, and secure long-term profitability.

Want to learn more?

For a more in-depth look at why old cost-management models don’t work and how to make robus models, you can read the telecom cost management whitepaper or contact us.