Discover the benefits of activity based costing for your company

Regardless of the industry you are in: knowing the root causes of your business success will help you to further increase that success! So, knowing what type of patients or procedures bring you the most profit in your hospital is similar to knowing the margin of certain loan types at a bank. Let’s look at the benefits of activity based costing to help determine the success of your business.

The increased need for more precise cost allocation

Whereas most companies and governments have a good insight in the direct attributable cost of their products and services, most struggle with all indirect costs. Direct attributable costs are bills of materials, man hours, etc. With the increase of technology, the ‘overhead’ costs are increasing. This calls for more precise calculations. Several industries have therefore adopted a more precise way of cost calculation. These initiatives appear in different names and forms (TBM for IT cost transparency, Time Driven Activity based costing, Rate based costing, etc). All these methods try to achieve the same goal: improve cost calculations. Let’s zoom in on the benefits of activity based costing.

The benefits of activity based costing vs. traditional costing

So what are the benefits of activity based costing? In traditional costing, one would use the overhead as an add-on to all products and services. This could be an absolute add-on (e.g. adding $10 for overhead on each contract) or a relative percentage (e.g. adding 5% for overhead on each contract). Traditional costing therefore doesn’t reflect the real differences between products and services. This is where the benefits of activity based costing come in. Management will probably not spend its time equally over the products and services, neither will the IT cost be similar for all products and services. Therefore, one needs to identify the true cost per product. One of the benefits of activity based costing is that it will show differences between two products that might have the same direct hours or bill of material. The benefits of activity based costing allow you to determine the true cost per product.

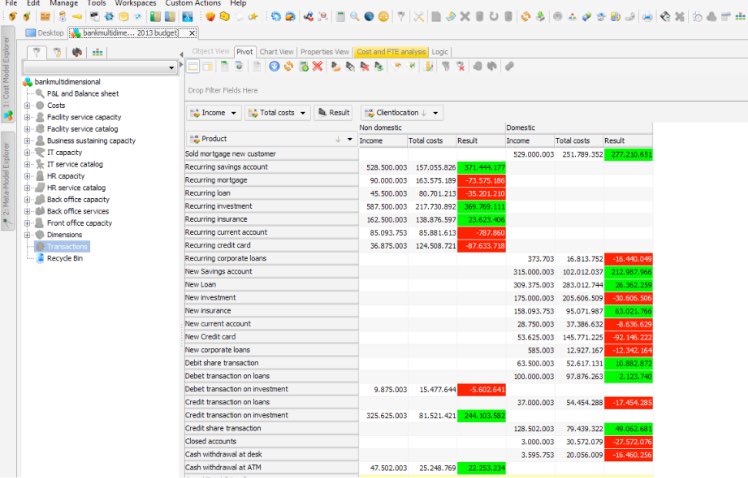

Utilizing the benefits of activity based costing, you can properly reflect costs and profitability.

Utilize the benefits of activity based costing

The problem with traditional costing systems, is that products and services will cross-subsidize each other without you knowing. This leads to the cost of ‘easy’ products and services being overestimated and ‘difficult’ products will be underestimated. Let’s look at two examples which illustrate the benefits of activity based costing methods.

A car manufacturer produces a basic vehicle without any extras, as well as a high-end SUV with many extra features. The manufacturer probably has an insight into the material cost differences between the two models. But what about the cost of the sales team? Or the cleaning staff? It’s plausible the sales team spends more time per SUV in comparison to the basic model. In most traditional cost systems, sales staff cost is simply divided by the number of vehicles sold or the revenue. Using the benefits of activity based costing, you would be able to map the activities of the sales staff to the right vehicle. A similar situation applies to the cleaning staff. Due to extreme quality tolerances, the level of cleaning should be much higher at the SUV production. Will this be reflected in the cost price? If you reap the benefits of activity based costing, it should.

Another example is an insurance company: let’s say you have customers of type A. They always use online channels to communicate, hardly claim anything, are satisfied with the services, etc. As opposed to the type B customer who requires a lot of admin work, always uses the phone for communication, and has high and complicated claims. The benefits of activity based costing allow you to make sure the profitability of those clients is reflected properly.

Summary

Lets summarize the benefits of activity based costing. It improves cost calculations, by moving away from general add-ons for every department. Instead, it allows you to look at the indirect costs per department, product or service. This gives you a better understanding of the performances across your business.